Loans + Credit Cards Assistance

Credit Cards

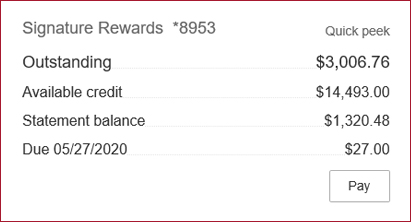

To make a credit card payment via WebBanking using an Allegacy account, visit My Accounts and click the PAY button beneath your credit card information.

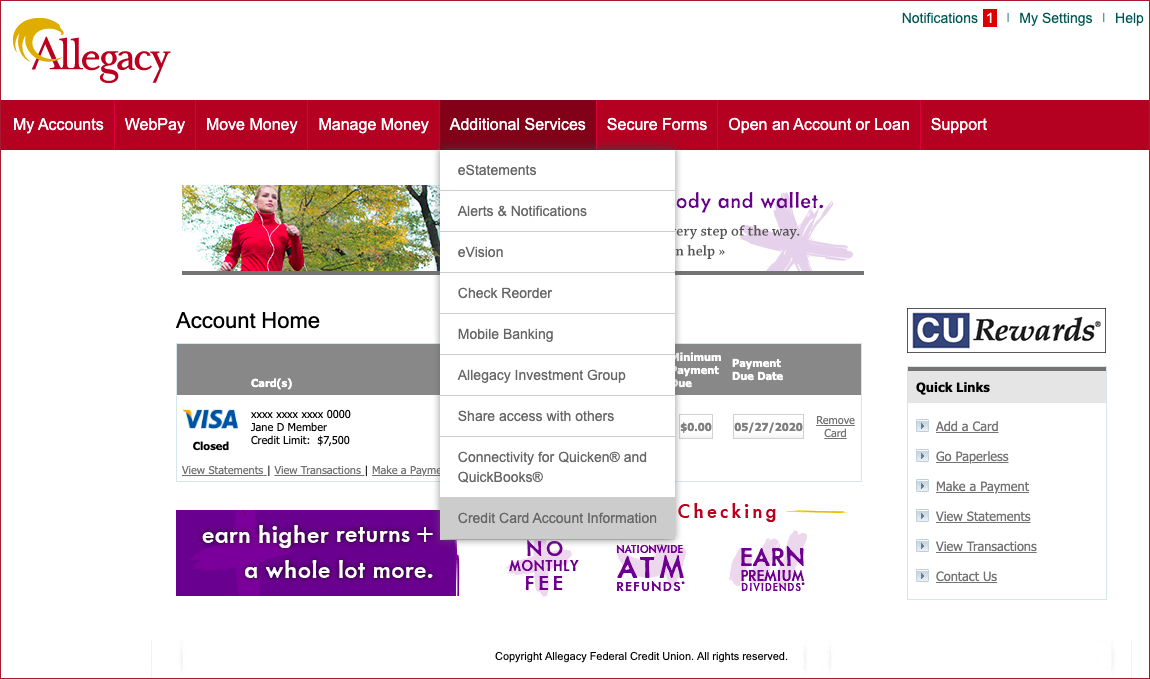

- Select Credit Card account information from your ADDITIONAL SERVICES toolbar.

- This will open your Credit Card WebBanking portal.

- Then select MAKE A PAYMENT from the right-hand side quick links.

- Choose the payment type and frequency of your choice and complete steps as they appear.

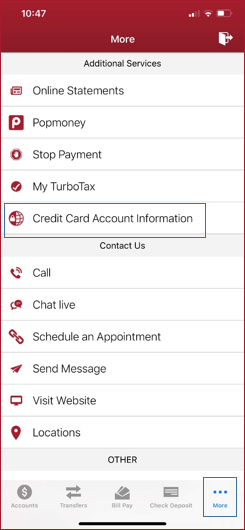

- Login to the mobile app and select the MORE feature in the bottom right hand corner.

- Then select Credit Card account information from your ADDITIONAL SERVICES list.

- This will open your Credit Card WebBanking portal.

- Then select MAKE A PAYMENT from the right hand side quick links.

- Choose the payment type and frequency of your choice and complete steps as they appear.

Homebuying

- You must be a member

- Funds to cover the appraisal fee

- Driver’s license and social security cards

- Most recent pay stubs (covering at least one month of pay)

- Two years proof of income

- If employed, last two year’s W-2 statements

- If self-employed, last two year’s tax returns with all schedules

- If disability income, last two months of statements showing deposit

- Last two month’s bank statements for any deposit/loan accounts not at Allegacy

- Most recent 401(K) statement

- Written explanation for any adverse credit

- If home is in a community with restrictive covenants or by-laws, we will need a copy as well as contact information for the Home Owner’s Association

- If separated or divorced, a recorded copy of your separation/divorce settlement

CLOSING COSTS

The costs you’ll pay at the time of purchase. These include things like the origination fee (usually 1% of your loan amount), commitment fee, appraisal fee, attorney fee, title insurance, homeowners insurance, recording fees, flood certification fee, etc.

DOWN PAYMENT

The amount of the purchase price that you’re paying up-front. Typically, lenders require a specific down payment in order to qualify for the mortgage.

PREPAYMENT

Making early or extra payments towards the principal. Prepayment can shorten the length of your mortgage and lower the total amount of interest you pay over time.

PRINCIPAL

The amount of money that you borrow for your mortgage.

EQUITY

The difference between the value of your home and what you still owe on your mortgage loan.

HOMEOWNER’S INSURANCE

AKA “hazard” insurance. Before you close on your mortgage, you will need to purchase a one year homeowner’s insurance policy with the minimum dwelling coverage of your loan amount.

LOAN TO VALUE

The percentage of your loan amount divided by your purchase price or appraised value, whichever is the lesser amount. Example: $150,000 loan amount divided by $175,000 purchase price/appraised value = 86% Loan-to-Value (LTV)

PRIVATE MORTGAGE INSURANCE

Insurance that protects the lender if you stop making payments on your loan. Required for loans with less than 20% down payment and the premium is paid in your escrowed portion of your monthly payment.

ESCROW PORTION OF YOUR PAYMENT

The monthly amount that is equivalent to 1/12th of your annual property tax bill and 1/12th of your homeowners insurance premium that is added to the principal and interest portion of your payment. If you borrow more than 80% of your home’s value/purchase price, you’ll be required to pay a monthly premium for Private Mortgage Insurance (PMI) in your escrow payment. Luckily, Credit Union PMI rates are significantly lower than other mortgage providers!

ORIGINATION FEE

The origination fee for a mortgage loan is part of the closing costs to be paid by the Buyer and is typically 1% of the loan amount. Origination fees are usually broken down into mortgage points, which are expressed as a percentage of the loan amount. So if the loan amount is $100,000 and theres a $1,000 origination fee, you are paying a 1% origination fee/point.